Wipro Ltd has now informed BSE that the Board of Directors of the Company at its meeting held on July 20, 2017, has approved a proposal to buy back up to 34,37,50,000 Equity Shares (Thirty

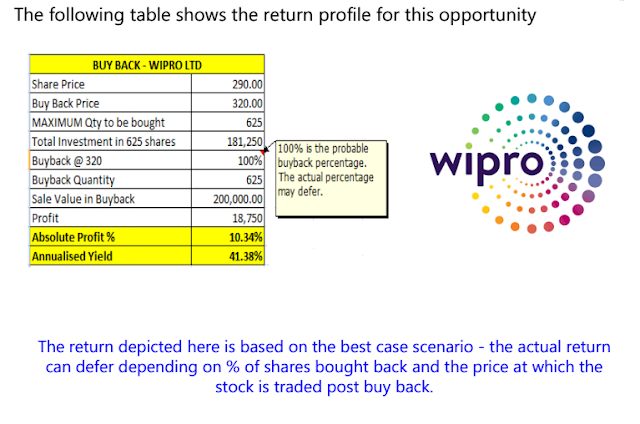

Four Crores Thirty-Seven Lakhs and Fifty Thousand Only) of the Company for an aggregate amount not exceeding Rs. 1,10,00,00,00,000/- (Rupees Eleven Thousand Crores Only) being 7.06% of the total paid up equity share capital, at Rs. 320/- Rupees Three Hundred and Twenty only) per Equity Share. The Buyback is proposed to be made from all existing shareholders of the Company (including persons who become shareholders by cancelling American Depository Receipts and receiving underlying Equity Shares) as on the record date on a proportionate basis under the tender offer route The Board noted the intention of the Promoter of the Company to participate in the proposed Buy-back.

The shareholding pattern of the company suggests that promoters hold 73.18% and of the 26.26%, which is held by the public, institutions hold 16.77%. While individual share capital up to Rs.2.Lac stands at 2.09%. Such shareholders are 246584 in number. Out of these twenty-four thousand odd shareholders who are holding below 625 shares (=2,00,000/320) representing capital worth Rs. 1250 could be drastically less.

0 comentários:

Post a Comment